Hi, my name is Adam Stewart, Debt Collection Expert and owner of ADC Legal Litigation Lawyers.

We travel all over Australia as part of our legal litigation services. We spend time with clients as they go over their credit control and accounts receivable processes. I would say that most of our time is actually spent consulting with credit managers and financial controllers around attempting to prevent bad debt, rather than finding ways to actually collect the bad debt.

With just a few adjustments to the way you handle your invoicing and accounts receivable, you can increase your cash flow, reduce bad debt and get time to put your feet up!

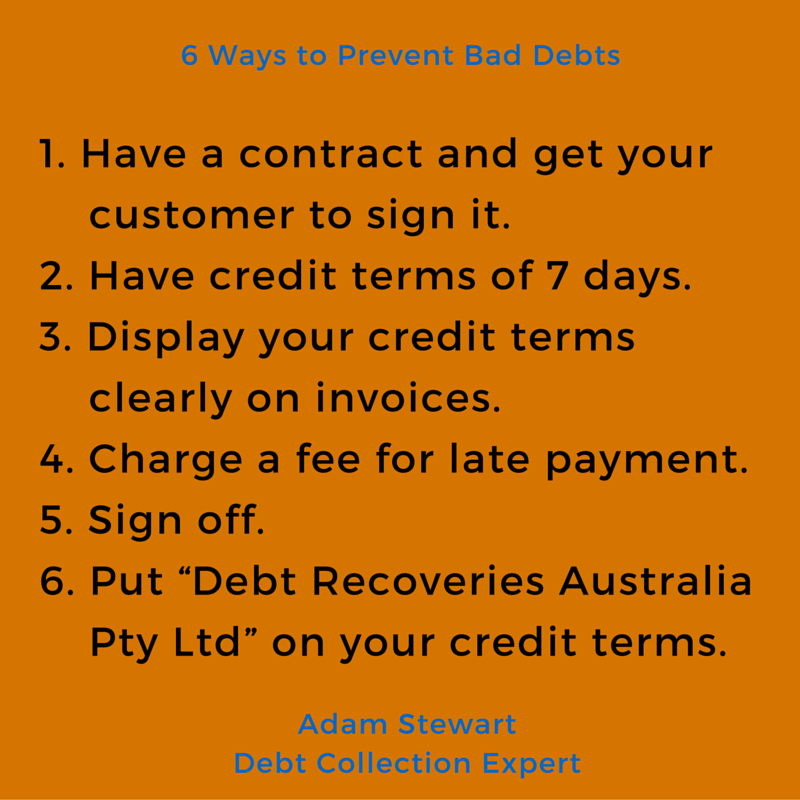

So here are my top 6 tips to prevent bad debts:

1. Have a contract and get your customer to sign it.

No matter how large or small the credit terms are for your customers, get them to sign a very comprehensive contract, listing all your terms and conditions, including very strict credit terms. They will respect you for it and it will demonstrate that you are serious about payment right from the very start.

2. Have credit terms of 7 days.

In today’s online world, there is no excuse as to why a customer cannot pay within 7 days, no matter how much the payment costs.

3. Display your credit terms clearly on invoices.

Put it in bold, at the top and bottom of each invoice.

4. Charge a fee for late payment.

Late payment fees should be clearly outlined in your contract and on each and every invoice you send out. Advise your customer you will charge interest and any or all recovery and legal fees incurred because of late payment. You may email me for some free templates.

5. Sign off.

If you are providing a service, have your client sign off at the beginning and again at the end of each contract.

6. Put “Debt Recoveries Australia Pty Ltd” on your credit terms.

We allow our clients to use our name, Debt Recoveries Australia Pty Ltd, on their invoices and credit contracts, especially when our clients are advising their customers of the consequences of late payment. After you have advised them of the interest and late payment fees, then advise them if payment is not received, the matter will be outsourced to your debt collection professional, Debt Recoveries Australia Pty Ltd. This will again send a strong and assertive message that you have stringent accounts receivable processes in place.

Please contact me if you would like some free templates on credit application contracts or invoices or if you would like us to help you with your commercial litigation, debt recovery and insurance disputes. Email me at email@adclegal.com.au or call 1300 799 820. You may also Skype me at adclegal.

photo credit: Designed by Freepik