Hi, my name is Adam Stewart, Debt Collection Expert and owner of ADC Legal Litigation Lawyers.

Even the best credit manager may eventually need the services of a good debt collection expert. Moreover, any business or company that provides credit will eventually need a good debt collection agency.

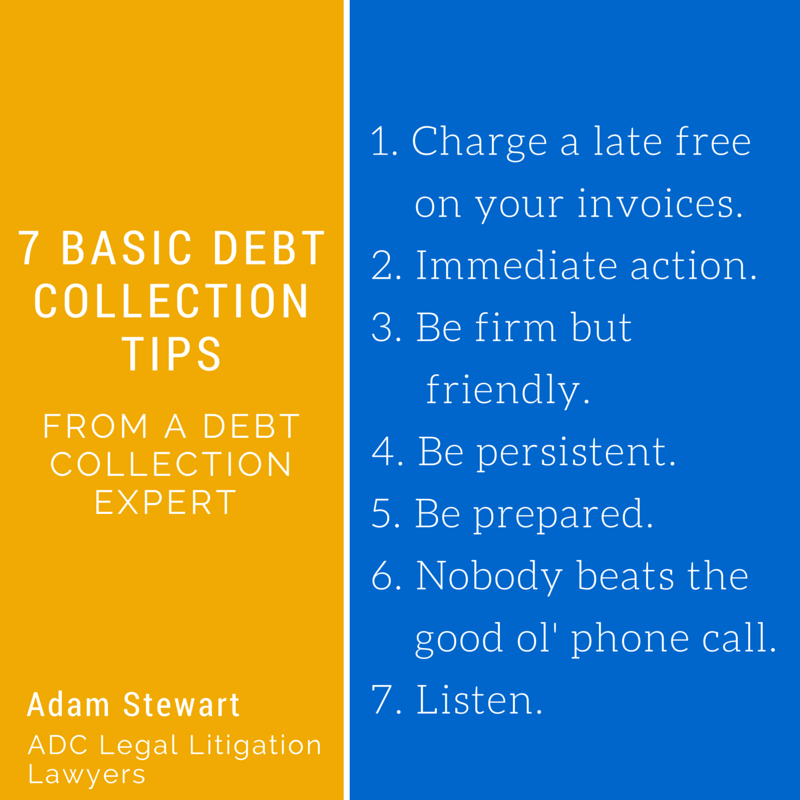

Before you get to that point, you may want to try your hand at collecting the debt yourself first. If you do, you are going to need a few pointers. These 7 basic debt collection tips are what I have learned over the years and the same points will get you quick payment and have your cash flow rolling again.

So the 7 basic debt collection tips from me are:

1. Charge a late fee on your invoices.

This is more a tip to help prevent bad debt but it’s my golden tip and it’s what I tell all our clients to do. Advise your customer that you will charge them interest and/or a recovery fee for any late payment. This will deter them from being late in the first place and it will send a strong message to your customers that you have firm credit practices in place.

2. Immediate Action.

Your debt collection should start the day the payment becomes due. Someone in your company should be calling or e-mailing the customer and asking for payment on the last day of your credit terms to find out why the account is not paid. Do not wait to start your collection effort. The longer an account remains unpaid, the less likely you will be successful in collecting the debt. Our recovery rate also goes down, the longer you wait to outsource to an agency.

3. Be firm but friendly.

Yes, it sounds obvious, but you catch more flies with honey than you do with vinegar and it is so true in debt collection. Get on side with the debtor and find out how you can work in with them, not against them. You can be assertive as well as friendly.

4. Be persistent.

This basic debt collection tip is what most debt collectors miss. One phone call or e-mail will not get you paid; you need to be friendly yet persistent. Be aware of the ACCC guidelines on the amount of contact you can have with your debtor and try to follow up as often as you can under these guidelines. Have a system that will send automatic e-mails or phone calls or short messaging service (SMS) on a regular basis. Try some software, such as Debtor Daddy or Chaser.

5. Be prepared.

As I always say, knowledge is power. Before you make your call, find out as much as you can about the possible reasons why payment has not been made. Think about possible excuses you might hear from the debtor and come up with your response before you pick up the phone. Plan what you want to say so you will not forget anything important.

6. Nothing beats the good ol’ phone call.

While letters, emails, SMS, etc. are all good tools to use in debt collection, the majority of any collection effort should be done by phone. Let us face it: you have already sent your invoice by email and it’s been ignored, so don’t repeat what has already been done. Get on the phone. Have a dedicated accounts receivable person who can make these calls on a regular basis each week.

7. Listen.

Done asking for the payment? Stop talking and listen for the response. Give your customer a chance to explain. Work with them to get to a win-win scenario. Once you understand the reasons for non-payment, you will be far better prepared to work with the debtor until payment is received.

Do you want to find out more how ADC Legal Litigation Lawyers can help you with your commercial litigation, debt recovery and insurance disputes? Email me at email@adclegal.com.au or call 1300 799 820. You may also Skype me at adclegal.