Hi, my name is Adam Stewart, Debt Collection Expert and owner of ADC Legal Litigation Lawyers. I am sure many collectors and Credit Managers out there have been wondering how to find out their credit rating for free.

First, what exactly is a credit rating and why is it important to you?

Credit Rating Agencies know your credit rating as a credit ratings score. This is a number calculated by Veda, from information in your credit report at a point in time. The main credit reporting body here in Australia is Veda. Veda stores their own, dynamically generated “Veda score”.

You can get your Veda credit rating score, for free, by contacting Veda on their website, www.MyCreditFile.com.au or by calling them on 1300 762 207.

In Australia, creditors like banks and utility companies may use a credit rating score. For example, your credit rating score could help lenders determine whether you can borrow, how much you can borrow, and at what rates. Financial institutions use your credit rating score to access your creditworthiness when applying for loans or such.

Some credit providers use credit rating scores as part of their credit risk assessment process. These scores may look at information on your application or your credit report or both. The credit rating score is typically used in conjunction with the credit providers own lending criteria.

Each credit provider, whether or not they use scoring, applies their own lending criteria when assessing applications for credit. That’s why one credit provider may approve your application while another may decline it.

It is a good idea to get a hold of your credit file, just so that you can see what your bank managers or lender sees and what information is actually on there.

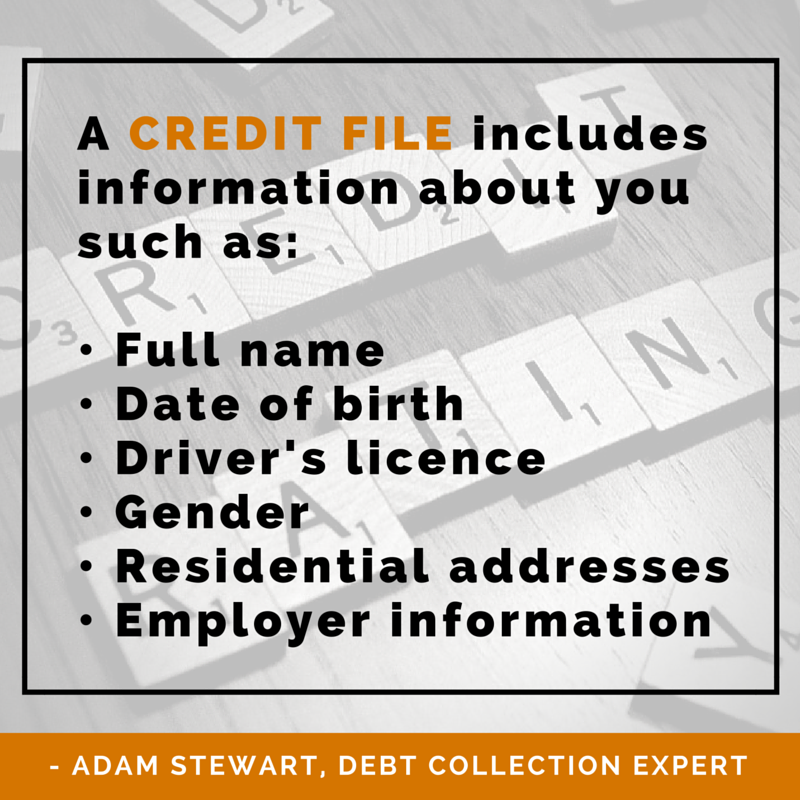

A credit file includes information about you such as:

- Full name

- Date of birth

- Driver’s licence

- Gender

- Residential addresses

- Employer information

In addition, a credit file may include the following:

- Consumer credit information which may include:

- Credit applications made in the past five years relating to loans for household, personal or family purposes as well as loans to purchase, renovate or re-finance a residential investment property

- Details of overdue consumer credit accounts.

- Type of credit account such as a credit card or personal loan

- Account open date and close dates

- Credit limit. This is the maximum amount of credit available to you for an account. If you accept a credit limit increase the new credit limit could be included on your credit history.

- Monthly repayment history on credit accounts such as mortgages and credit cards.

In addition, for the purposes of consumer credit reporting only, the following publicly available information may also be listed:

- Court judgments and court writs

- Directorship details

- Proprietorship details

- Bankruptcy, debt agreement and personal insolvency information.

So apply for a free credit rating today. Knowledge is power and it’s good for you to know exactly where you stand.

If you are experiencing financial difficulty, you can also obtain free, confidential advice, by going to the Financial Counselling Australia website, which is http://www.financialcounsellingaustralia.org.au.

ADC Legal- Litigation Lawyers is a legal practice specialising in commercial advice and litigation, debt recovery and insurance claims recovery disputes. We have proven expertise in handling the most complex commercial litigation and we handle litigation and debt recovery matters for companies and businesses, through our agents, in all states of Australia. Call us on 1300 799 820, chat at Skype: adclegal or visit our website at https://adclegal.com.au/.